Irish Pharmacy News has been working with human data science company, IQVIA, for the last seven years to comprise this annual report which highlights the Top 100 Over-the- Counter pharmacy brands in Ireland.

The information contained over the following pages is widely accepted as the industry standard from which brand performance is measured across the OTC sector.

We spoke to General Manager of IQVIA, Gwynne Morley, to gain further insights into how these statistics are compiled and on the value of this market to pharmacy.

The Top 100 data is collated each year and summarises activity from May ‘21 to April ‘22. IQVIA uses data, technology, advanced analytics, and expertise to help customers across healthcare drive health forward. For many of these customers, having an accurate, timely view of product performance is critical to ensuring they are improving both business and patient outcomes.

The Top 100 Over the Counter (OTC) Market Report is based on the total value of wholesale sales for OTC products into retail pharmacy over the course of the previous 12 months to April 2022 (May 2021- April 2022).

It’s a rolling annual value which includes the 5 major OTC categories including Pain relief, Cough and Cold remedies, Vitamins and Minerals, Skin and Digestive Health.

About IQVIA

IQVIA (NYSE:IQV) is a leading global provider of advanced analytics, technology solutions, and clinical research services to the life sciences industry. IQVIA creates intelligent connections across all aspects of healthcare through its analytics, transformative technology, big data resources and extensive domain expertise. IQVIA Connected Intelligence™ delivers powerful insights with speed and agility — enabling customers to accelerate the clinical development and commercialization of innovative medical treatments that improve healthcare outcomes for patients. With approximately 79,000 employees, IQVIA conducts operations in more than 100 countries.

Present in Ireland since 1990, IQVIA pioneered the country as a hub for clinical research. In addition to supporting life sciences in their clinical efforts across Europe and the globe, IQVIA’s activity in Ireland includes supporting the life sciences industry from R&D through to commercialization, as well as healthcare providers, to improve treatment outcomes and patient pathways.

Value of the OTC Market to Pharmacy

Gwynne tells us, “The total value of the Over the Counter (OTC) market in Ireland based on IQVIA’s data for the 12 months, May 2021 to April 2022, was €501 million. 1 This market grew by 23.2% (value) & 22.7% (volume) when comparing year-on-year growth. 2

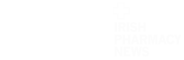

“The 5 major OTC categories (including Pain relief, Cough and Cold remedies, Vitamins and Minerals, Skin and

Digestive Health) account for €378 million 1 of the total value. Please see below the previous period growth rate Moving Annual Total (MAT) April 2022 2 for each of these four categories:

“Pain relief continues to be the most consumed OTC products in Ireland. The growth of this market declined in 2021, mainly due to the increased demand in over-the-counter painkillers by consumers in March 2020 in anticipation of the pandemic – 808,000 units were supplied to Irish pharmacies; an increase of 164% on the same week in 2019. This unprecedented demand exaggerated the growth in this market in 2020 as consumers had stock-piled pain medication in their homes and, it was perceived that growth in 2021 was poor. This is a contributing factor to the strong growth in this category in 2022.”

The Cough and Cold remedies category declined significantly in the period from May 2020 to April 2021. Gwynne adds, “In fact the value of this market was 50% of the value for the same period the previous year (i.e., May 2019 to April 2020). This decline was the outcome of successive lockdowns and adherence to the key messaging from government to stay at home, maintain social distancing and adopt good personal hygiene practices – there was significantly reduced transmission of respiratory viruses during this period. Due to the lifting of these restrictions and the return of social interactions, this category has experienced unprecedented growth in 2022 and the value of the market has returned to pre- COVID levels.

“In contrast, vitamins and minerals (VMS) have experienced unprecedented growth since March 2020. This category has experienced growth each year since the outbreak of the pandemic. This is primarily due to increased awareness of self-care and the benefits of vitamins and minerals, initially to fight COVID-19 by boosting immunity, but now consumers have adopted the consumption of VMS as a habit.

“Calming, sleep and mood enhancing products continue to grow at 19.5% PPG MAT April 2022. 2 This category now accounts for 1% of the value of the OTC market compared to 0.3% pre-COVID. This suggests that a significant number of the population continue to struggle with anxiety and insomnia.”

The Global Over the Counter (OTC) market is recovering faster than expected, following COVID-19 pandemic, Gwynne reflects.

“After a rough 2020 due to the pandemic, 2021 saw 6.7% growth, led by nutrition and gastrointestinal categories, according to IQVIA Consumer Health’s Global OTC Insights data. Analgesics also picked up significantly. The cough cold category, which was hardest hit during the pandemic, was still behind at -4%, but we expect that to flatten in 2022. 3

“IQVIA Consumer Health is forecasting the Irish OTC market will grow in 2022 by +5.5% 4

“The essential role that pharmacies play in delivering healthcare in the community has been ably demonstrated during the COVID-19 pandemic. As the most accessible of all healthcare professionals, community pharmacies have provided a nationwide service to patients and the public in extraordinarily difficult circumstances. Across EU4 countries + UK + Ireland, there has been significant growth across the pharmacy channels – the Irish pharmacy channel grew stronger than the EU4 countries + UK for MAT Q1 2022 5 (see figure 1). As the public has trouble accessing GPs and services, more patients are turning to their local community pharmacist as a trusted healthcare professional for the treatment of minor ailments and health advice/ guidance. Pharmacy in the future has the opportunity to become a neighbourhood health destination – the integration of personal wellness data from digital apps, should support the coupling of product, service, and data, and enable the community pharmacy to transition from the traditional role of prescription filling to delivering holistic consumer care.

We asked Gwynne what are the key trends currently affecting/changing the consumer health market in Ireland?

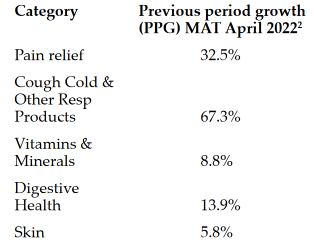

“Coming out of the COVID-19 pandemic, we see some key trends buffeting the consumer health industry. Health has become a proactive priority for consumers and the drivers of influence are diverse. For proactively engaged consumers, reasons range from the desire to live a longer, healthier life, and a desire to look and feel better post lockdown, to the sway of social media and the burden of rising costs of healthcare (see figure 2)

“Rather than seeking medical treatment, more consumers are opting for self-care interventions for various reasons, including convenience and cost; extending to areas such as fitness, mental wellbeing, and diet to prevent illnesses and ailments; and boosting their natural immunity for the future (figure 3). However, due to hectic lifestyles and dayto-day pressures, not all consumers can dedicate the time necessary to live healthy and balanced lifestyles. Instead, people turn to over the counter (OTC) medicines with 24/7 access for symptomatic relief or vitamins and nutritional supplements to focus on wellbeing.

“Consumers now have access to a wider range of information at their fingertips. Their purchase decisions are no longer driven by one variable, but several variables working in tandem. The same consumers and shoppers are re-visiting their values and forcing firms to focus on sustainability, high quality ingredients, natural products, medication with noside effects, to match their values and aspirations. Of course despite opportunities, there are always challenges in any market.

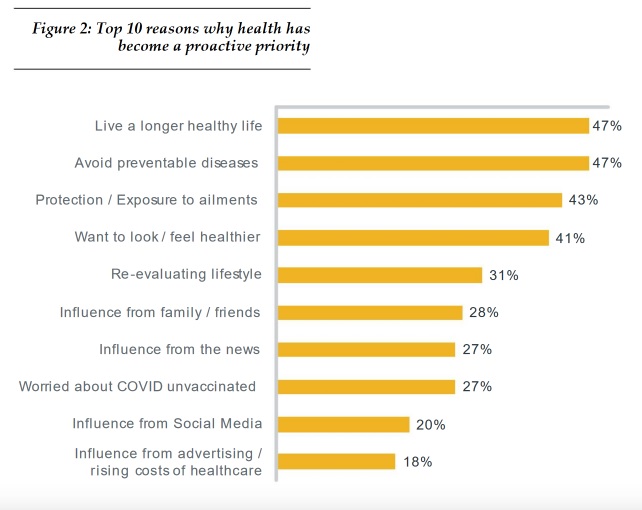

“E-commerce is now a must-win channel,” says Gwynne.

“We continue to see a blurring of lines between in-store and ecommerce shopping. This trend began before the pandemic, but COVID accelerated consumers’ willingness to engage with digital services and sales using mobile technology. Health and beauty are now leading e-Commerce categories, with consumer health categories such as VMS benefiting from the rise of online subscription models which match the consistent, repeat purchase behaviour of that category’s consumers. Urgent need products, like pain medication and cough and cold products, are still showing strong offline sales due to the inconsistency of their use.

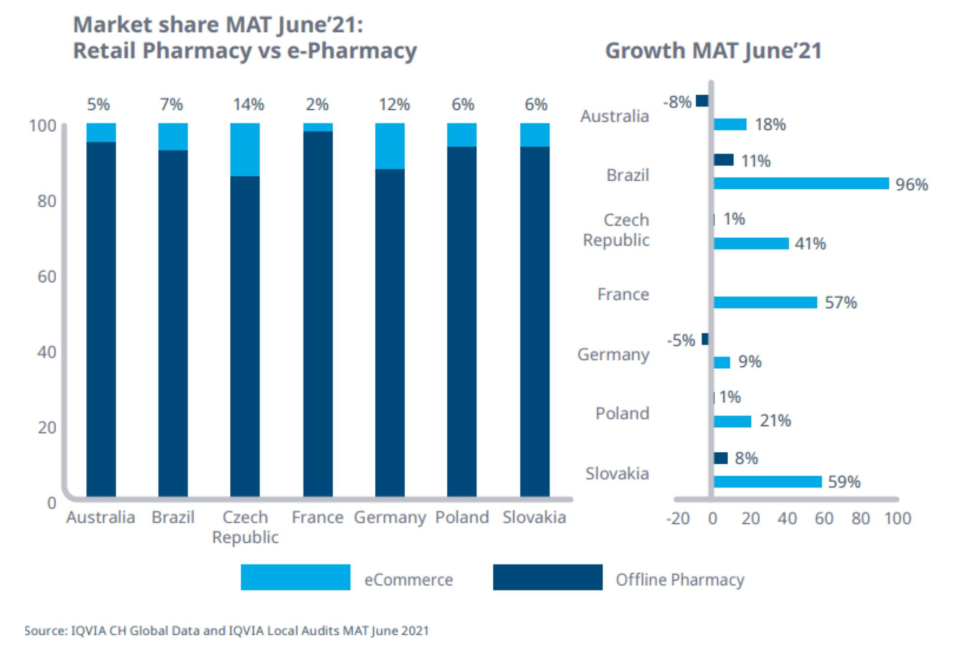

“IQVIA Consumer Health’s e-Pharmacy data shows that already around a fifth of consumer health sales in the US, Germany, and China now goes through e-Pharmacies and other e-Commerce channels (see figure 4). This doesn’t mean brick-and-mortar shops will disappear. But it will require a more cohesive sales and marketing strategy, where e-Pharmacies, independent pharmacies, chains, and wholesalers work collaboratively to offer a seamless omnichannel brand experience.

Has the contribution of innovation to the OTC market in Ireland increased or decreased over the last 12-18 months?

Gwynne adds that in an environment where growth is becoming harder to achieve through volume or price, innovation has become the main growth and value driver.

“Connected consumers also expect more from consumer health players,” she says. “They are more informed, have different expectations (e.g., sustainability, locally sourced, natural) and have a wider access to products and information from many online and offline channels. Yet the level of innovation in consumer health remains relatively low compared with other industries, and although it has increased in recent years, it remains hampered by regulatory and structural constraints. “Moreover, the type of innovation itself is far from being disruptive, as it is in many cases limited to pack sizes, new flavours, or forms, as consumer health players slowly pick up new trends such as personalisation and digital health.

“Innovation in the OTC market in Ireland has primarily been driven by the launch of new medicinal products recommended for the treatment of allergies and erectile dysfunction. These launches have contributed sales of approximately €10 million MAT April 2022 2 to the Irish OTC market, which accounts for approximately 50% of total sales attributable to new launches in the Irish OTC market in the past 12 months. Historically, these products were only available on prescription in Ireland. The other new launches were line extensions, new pack sizes or new flavours of existing brands available in the Irish market.”

What impact is the rise of e-pharmacy and the new ‘digital shopper’ having on the market for OTC medicines in Ireland?

“The Consumer Health industry is thriving despite the chaos caused by the pandemic — and in some cases, because of it. The 18 months that consumers spent stuck at home, wearing masks, and avoiding public spaces has spurred innovation in the consumer health sector, and caused consumers to rethink their approach to health and wellness.

“With consumers forced to avoid shopping centres, they moved more of their day-to-day purchases online, with e-Pharmacies providing a safe and convenient online channel for purchasing essential healthcare products. As a result, e-Pharmacy sales now contribute about 5-10% of the global consumer health market (see figure 5). IQVIA Consumer Health’s e-Pharmacy data indicates that most countries will see high single digit to low double digit growth in e-Pharmacy sales through the end of 2021, while offline pharmaceutical sales will stagnate. This shift in shopping behaviour is expected to continue, making e-Pharmacy a major player in the consumer health marketplace in the years to come.

“Global growth on the consumer health marketplace is being driven by a growing interest in health and wellness, easy access to digital shopping options and more personalized product selections. Payers are also looking to shift more responsibility for health and wellness to individuals by focusing on prevention as a proactive care option. These health and wellness trends are being bolstered by the adoption of lifestyle apps, wearables, and other health-driven technology that encourage healthy behaviour and proactive self-care. Many government agencies and insurance providers are now taking advantage of these tools as a strategy to improve population health.

“For example, Fitbit, maker of wearable fitness monitors, recently partnered with the Singapore Health Promotion Board to provide trackers paired with subscriptions and targeted programming to encourage healthy living in the country. Fitbit is also a named covered fitness benefit by 42 Medicare Advantage plans across 27 U.S. states.

“In Ireland, Irish Life has introduced MyLife which is a personalised health and wellness app and online platform that rewards Irish Life Wellbeing members for making better lifestyle choices each day. Consumers are also interested in capturing their health data to guide personal and global health strategies, which is driving interest in fitness trackers, health apps, and genetics testing kits. These include 23andMe, the personalized gene testing kit company, which now boasts 11 million customers near-80% who have agreed to share their genetic information for disease research.

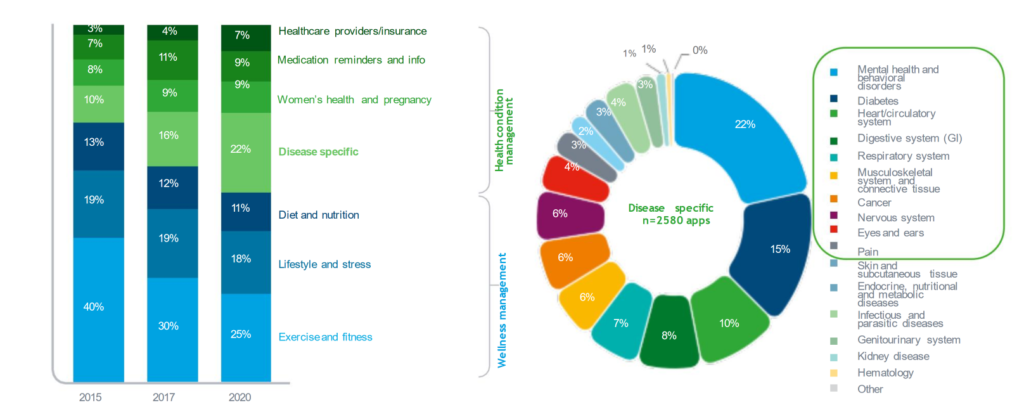

“In 2020, disease-specific apps represented 22% of all apps in the marketplace (see figure 6). Of those, the leading topics include mental health, digestive, respiratory, musculoskeletal pain, eyes, and ears, which align with consumer health product categories.

What does Gwynne – think the OTC Medicines market in Ireland will look like for the remainder of 2022 going into 2023?

“The Irish Over the Counter (OTC) market demonstrated an amazing recovery in the second half of 2021, clocking a FY2021 growth of +12% (vs. 2020). 6 We expect this double-digit growth to reduce to 5.5% for 2022 4 and we are forecasting 5.6%

IQVIA Key Trends in growth Shopper for Behaviour 2023. 6 ”

Please see below observations about how (and when) consumers shop online: 8

• Most category-relevant actions take place between Mondays and Wednesdays with the lowest activity levels during the weekend.

• While the bulk of online shopping takes place between 9am and 11pm, unbranded organic searches are about twice as likely to occur between 11pm and 9am (about 29%).

• Online shoppers are six times more likely to visit an e-Pharmacy website than Amazon.

• E-pharmacy and Amazon visitors review paid and organic branded searches before making a decision. Both groups use price comparison websites.

• e-Pharmacy and Amazon category relevant actions tend to spike around 11am, 8pm, and between 11pm and 1am.

• Amazon visitors twice as likely as e-Pharmacy visitors to visit the brand’s websites.