Irish Pharmacy News has been working with human data science company, IQVIA, for the last nine years to comprise this annual report which highlights the Top 100 Over-theCounter (OTC) pharmacy brands in Ireland.

The information contained over the following pages is widely accepted as the industry standard from which brand performance is measured across the OTC sector.

We spoke to the General Manager of IQVIA, Gwynne Morley, to gain further insights into how these statistics are compiled and the value of this market to pharmacies.

The Top 100 OTC Market Report is based on the total value of wholesale sales for OTC products into retail pharmacy over the course of the previous 12 months to April 2024 (May 2023- April 2024).

It’s a rolling annual value which includes the 5 major OTC categories including Pain relief, Cough and Cold remedies, Vitamins and Minerals, Skin and Digestive Health.

About IQVIA

IQVIA is a leading global provider of clinical research services, commercial insights and healthcare intelligence to the life sciences and healthcare industries. IQVIA’s portfolio of solutions are powered by IQVIA Connected Intelligence™ to deliver actionable insights and services built on high quality health data, Healthcare-grade AI™, advanced analytics, the latest technologies and extensive domain expertise. With approximately 87,000 employees in over 100 countries.

Present in Ireland since 1990, IQVIA pioneered the country as a hub for clinical research. In addition to supporting life sciences in their clinical efforts across Europe and the globe, IQVIA’s activity in Ireland includes supporting the life sciences industry from Research and Development through to commercialisation, as well as healthcare providers, to improving treatment outcomes and patient pathways.

1. Can you give our readers an overview as to how the Top 100 data is collated?

The Top 100 OTC Market Report is based on the total value of wholesale sales for OTC products into retail pharmacy over the course of the previous 12 months to April 2024 (May 2023- April 2024). It’s a rolling annual value which includes the five major OTC categories including pain relief, cough, cold and respiratory products, vitamins and minerals, digestive health, and habit treatment.

2. Can you give readers a brief overview as to the value of the OTC market to community pharmacy? And what are the key trends currently affecting/changing the consumer health market in Ireland?

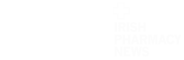

The total value of the OTC market in Ireland based on IQVIA’s data for 12 months, from May 2023 to April 2024, was €571 million1. This market grew by 2.1% (value) and decreased by 3.1% (volume) when comparing year-on-year growth2. This was significantly lower than the forecasted growth as Ireland’s value sales growth for 2023 was expected to be 6%. The global OTC market also underperformed forecasts as a notably weak cough and cold season restricted overall value sales growth to 3.9% for 2023, see Figure 1. As the largest market segment globally, the performance of the cough and cold category strongly influences the overall growth trajectory of the OTC market. With subdued seasonal activity globally, the market faced downward pressure, highlighting the sector’s susceptibility to seasonal variations.

The five major OTC categories (including Pain Relief, Cough, Cold and Respiratory products (CCR), Vitamins and Minerals, Digestive Health, and Habit Treatment) account for €450 million1 of the total value. See the Previous Period Growth (PPG) Moving Annual Total (MAT) April 20242 for each of these five categories: Unlike other markets, Cough, Cold and Respiratory Products (CCR) is the second largest category in the Irish OTC market – Pain Relief continues to be the most consumed category in Ireland, valued at €157 million MAT April 2024 versus €106 million MAT April 2024 for CCR1. This category declined by 2% in 2023 versus double digit growth of 10% in 20221, contributing to Ireland’s significantly lower sales value growth versus global sales value growth levels.

Habit treatment was the only category that experienced double digit growth, with +11% Previous Period Growth (PPG) MAT April 20242. This increase in consumers seeking smoking cessation treatments in Ireland during 2023 can be attributed to increasing awareness about the health risks associated with smoking, more consumers are motivated to quit. The Smoking Prevalence Tracker data indicates an underlying downward trend in smoking prevalence in Ireland3. Recognised as crucial for tobacco control, cessation services play a vital role in helping people quit smoking. Nicotine Replacement Therapy (NRT) products are part of evidence-based strategies to support individuals in their journey to quit4. Despite efforts, the goal of a TobaccoFree Ireland by 2025 remains challenging5.

Vitamins and Minerals, the third largest category in the OTC market, valued at €80 million MAT April 20241, grew at a modest rate of 3.2% PPG MAT April 20242. This is a category that is sensitive to price increases. Calming, sleep and mood enhancing products continue to grow faster than market value growth at 6% PPG MAT April 20242, which suggests that a significant number of the population continue to struggle with anxiety and insomnia.

The category that continues to decline quite significantly is Weight Loss, -19.6% sales value growth PPG MAT April 20242 Consumers are becoming more aware of evidence-based weight loss options and the availability of more effective prescription options. Recent innovations in the treatment of obesity in the prescription market has more than likely negatively impacted the OTC sector of this category.

3. It would be fair to say that Covid-19 resulted in more consumers taking control of their own health. Would you say that the era of greater ‘self-care’ awareness is evident in these Top 100 figure compared to previous years?

The COVID-19 pandemic certainly accelerated the trend to greater self-care and personal health management due to safety concerns and limited in-person medical consultations at that time. Selfcare is also the future, with consumers worldwide desiring more access to healthcare, and more control over their own care, while governments and payors look to reduce costs by encouraging people to adopt healthier lifestyles and self-manage more conditions when safe to do so. Consumer health products are pivotal in facilitating efficient self-care. These products empower individuals to proactively manage their health, address minor health issues promptly, monitor chronic conditions, and help cultivate a health-conscious society and alleviate the burden on healthcare systems.

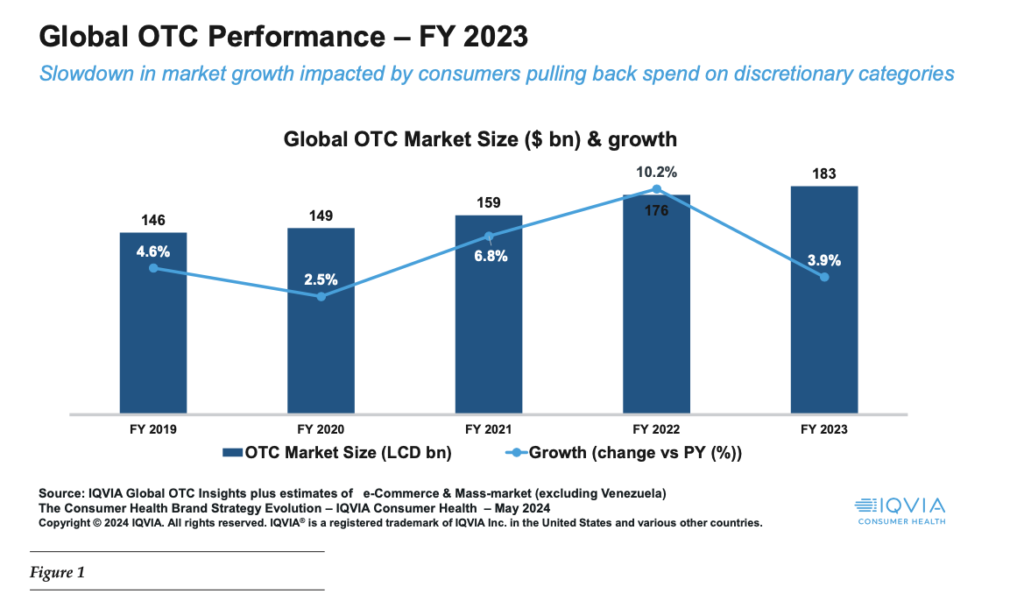

Albeit the OTC market in Ireland continues to grow, the growth has been significantly lower than previous years. Uncertainty is impacting consumer purchasing behaviour, as shown in Figure 2. In addition to the market’s susceptibility to seasonal variations, survival instincts reign supreme – consumers intend to spend more on essential categories, such as health & wellness, but concerns about inflation, resulting in higher prices, has been the subject top of mind across all consumers over the past 12 months, see Figure 3. As a consequence, choices are being made between ‘need to have’ healthcare products and ‘nice to-have’ aspirational products, altering the market dynamic across categories. This has obviously impacted on the lower sales value growth in the OTC market in Ireland in 2023.

4. What do you think is currently driving medicine spending in Ireland? What do you envisage will be the driver for the next 5 years?

Our ageing population is certainly a contributing factor to the current and future medicine spend in Ireland, as it places additional demands on healthcare systems and medicine expenditure. Ireland’s population has grown by 9% over the past decade, reaching over 5 million people6; the first time it has surpassed this number since 1851. Approximately 14.8% of people in Ireland are aged 65 or older7. By 2051, it is projected that one in four people (26%) will be over the age of 65 in both the Republic of Ireland and Northern Ireland8. Among Irish individuals aged between 52-85 years, around 39% are living with multimorbidities9. Self-care is paramount in this instance. The National Framework for the Integrated Prevention and Management of Chronic Disease in Ireland 2020-2025 explicitly considers self-care as a critical component10. This framework focuses on shifting most of the chronic disease care into communitybased settings. It addresses four major chronic diseases: type 2 diabetes, asthma, Chronic Obstructive Pulmonary Disease (COPD), and cardiovascular disease10. By emphasising community care and empowering individuals, the framework recognises the importance of self-care in preventing and managing chronic conditions.

5. Do you agree with the idea that consumers are shifting from a ‘symptom’ model to a ‘prevention’ model when looking at OTC medicine needs? How is this apparent within the latest OTC figures?

This shift in consumers behaviour, from ‘symptom’ control to ‘prevention’, is evident in the above data showing the growth of Vitamins & Minerals, and the Habit Treatment categories. These products empower individuals to proactively manage their health. In today’s market, consumers are no longer passive recipients of healthcare – they are increasingly knowledgeable and technologically adept, seeking products that cater specifically to their needs and preferences. Consumers are also increasingly aware of preventive measures, nutrition, fitness, and mental well-being. This awareness drives selfcare behaviours.

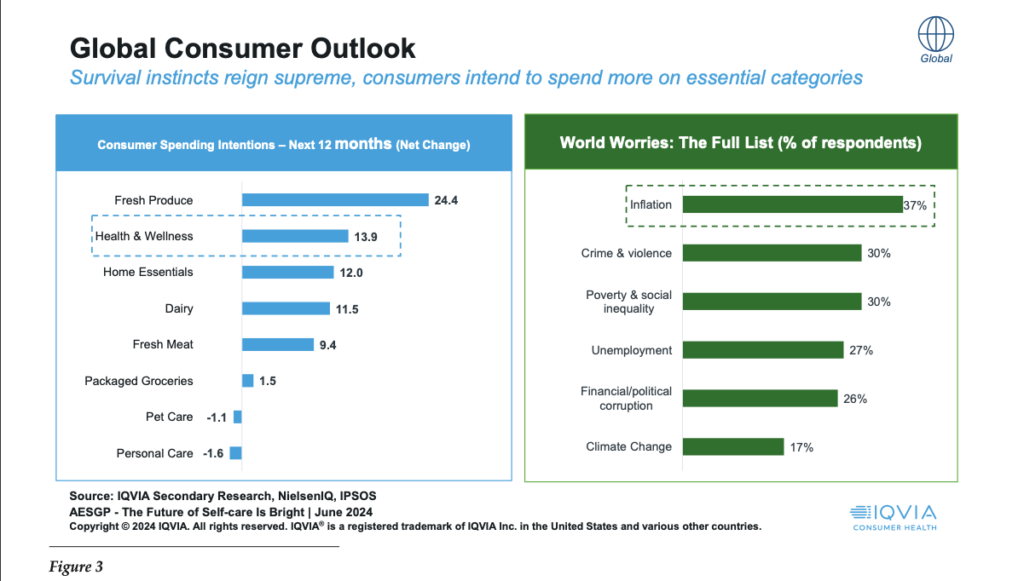

Holistic self-care moving beyond symptom treatment is also being driven by the rise of digital health tools. Technology enables personalised health monitoring, telemedicine, and wellness apps. These tools empower individuals to manage their health proactively. A broad range of solutions – including consumer health apps and wearable devices such as smart watches and activity trackers — are well established in the market, see Figure 4. Biometric sensors can be included in such devices or used separately, as in connected glucose or heart rate monitors while even basic smartphone tools such as the camera and microphone can measure health related data. For example, stress levels can be tracked through fingertip photoplethysmography, a non-invasive approach using a light source and a photodetector at the skin’s surface to measure variations in blood circulation11.

Smartphones can also detect the sound signature of coughing and snoring. Data gathered via these devices can then be analysed using diagnostic algorithms and AI/ML approaches, a development which is having an increasing impact on consumer health on both the consumer and manufacturer sides. In addition to consumer users, the HSE also recognise the benefits of utilising digital heath technologies, with the introduction of the National Virtual Ward programme12 and the HSE Telemedicine Roadmap 2024202713. Possibly the biggest opportunity for the consumer health industry with the rise of digital health, is its ability to streamline clinical trials and openup new ways of generating evidence. The industry can use virtual tools to collect health data through digital channels, helping to make research less burdensome and more consumer centric, while improving adherence and outcomes, and gaining an improved understanding of the real-world efficacy and safety of products and services.

6. E-Commerce has grown over the last couple of years. What impact do you think this has had, if any, on the OTC medicines landscape?

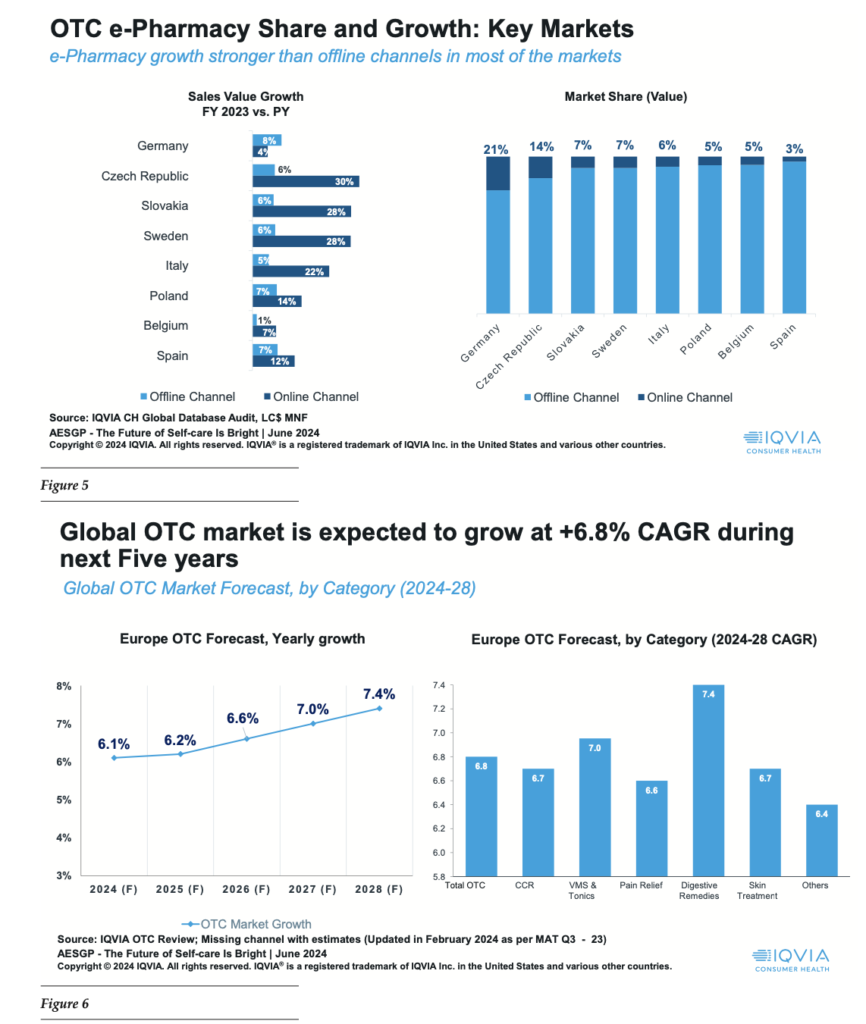

The rise of E-Commerce has impacted the landscape of OTC medicines. In 2023, the sales value growth of OTC e-pharmacy was stronger than offline channels in most markets, see Figure 5. Consumers have not abandoned retail pharmacies, with advice and consultation still valued highly. However, there are benefits to e-commerce, such as the following:

1. Enhanced accessibility and convenience: E-Commerce platforms have made OTC medicines more accessible to consumers. People can now conveniently order medications online, eliminating the need for physical visits to stores14.

2. Consumer empowerment: E-Commerce also allows consumers to research products, compare prices, and read reviews before making a purchase. This empowerment enables informed decisions about OTC medicines, promoting self-care and health literacy15.

3. Wider range of choices: Online pharmacies offer a broader selection of OTC products, providing consumers with more options. This variety ensures that people can find the most suitable medications for their needs16.

As technology continues to evolve, E-Commerce is likely to play an increasingly significant role in shaping how consumers interact with and purchase OTC healthcare products17.

7. What do you think the OTC Medicines market in Ireland will look like for the remainder of 2024 going into 2025?

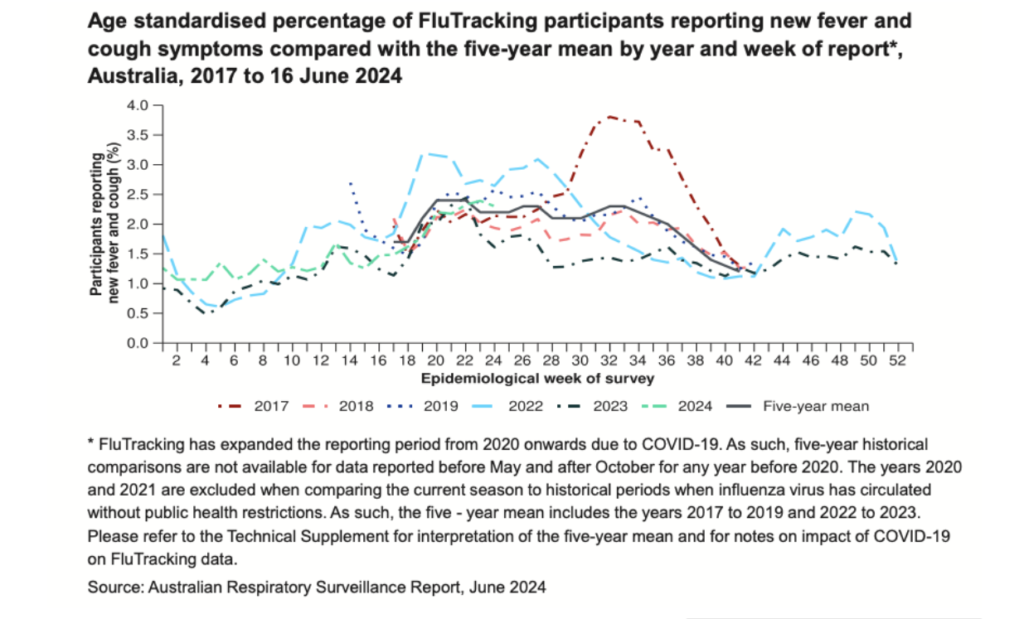

The Global OTC market is expected to grow at +6.8% CAGR during the next five years, 2024-2818. It is also forecasted that Europe’s OTC market will grow at 6.1% in 2024, see Figure 6. Growth within Ireland’s OTC market is not as optimistic based on the performance of the first half of the year – sales value growth is flat, 0.4% PPG 6-month April 20242. The two largest categories in the OTC market, Pain Relief and CCR, have declined quite significantly in the first half of the year, -6.3% PPG six months April 2024 and -2.5% PPG six months April 20242 respectively. The overall market pace slows down when these segments underperform. Unless there is a high incidence of flu later in the year, Ireland’s OTC market growth for 2024 is forecasted to be flat or low digits. Data from the Australian Respiratory Surveillance Report19 indicates the incidence of fever and cough for flu in 2024 is currently similar to the proportion observed in the same period in all previous years (excluding 2022) and the five-year mean (see Figure 7).

8. What are the current trends with regards to shopper behaviour within the OTC landscape?

In Ireland, the key consumer health trends driving shopper behaviour within the OTC landscape can be segmented into the following pillars:

1. Prioritising self-care and wellbeing: As highlighted in the OTC market data above, shoppers are prioritising preventive health measures. They are seeking OTC products related to immunity, vitamins, and supplements, and habit treatments. This has been caused by the pandemic which has heightened awareness of health and wellness.

2. Local and sustainable: There’s a growing interest in supporting local brands and sustainable products. Consumers appreciate transparency about ingredients, sourcing, and ethical practices.

3. Personalisation: Consumers are looking for products customised to their individual nutrition needs, such as DNA-based diets, personalised supplements, and smart devices.

4. Convenience: Busy lifestyles drive demand for convenient formats like single-dose sachets, travel-sized packs, and easy-to-use applications.

5. Digital shift: E-commerce platforms and mobile apps have become popular for ordering supplements, and personal care items.

6. Pharmacist recommendations: Shoppers trust pharmacists’ advice. According to the IPSOS Veracity Index 2023 edition20, healthcare professionals are again the three most trusted professions, with Pharmacists regaining the top spot. The IPSOS Veracity Index is the longest-running poll on trust in professions in Ireland, first measured in 2005. The 2023 edition, conducted via nationally representative telephone survey, tracked the latest movements in public trust in key professions. Pharmacies remain a key channel for OTC purchases, and consumers value professional guidance.

References:

1. IQVIA OTC Ireland Monthly Database, MAT April 2023

2. IQVIA OTC Ireland Monthly Database, Previous Period Growth April 2023

3. https://www.hse.ie/eng/about/who/ tobaccocontrol/research/smoking-inireland-2023.pdf

4. https://www.hse.ie/eng/about/who/ tobaccocontrol/cessation/

5. https://www.hse.ie/eng/about/who/ tobaccocontrol/research/state-of-tobaccocontrol-report-2022.pdf

6. People Statistical Yearbook of Ireland 2021: Part 1 People and Society – Central Statistics Office

7. Population aged 65+ Ageing Population Older Persons Information Hub – Central Statistics Office

8. https://publichealth.ie/sites/ default/files/2023-02/wp-content/ uploads/2020/04/20200416-AGEINGPUBLIC-HEALTH-MAIN.pdf

9. The Irish Longitudinal Study on Ageing (TILDA) – Trinity College Dublin (tcd.ie)

10. https://www.hse.ie/eng/about/who/cspd/ icp/chronic-disease/documents/the-chronicdisease-integrated-care-programme-10step-guide.pdf

11. IQVIA White Paper, The Next Wave of Self Care Digital Health, February 2023

12. https://www.hse.ie/eng/about/who/ strategic-programmes-office-overview/ national-virtual-ward-programme/

13. https://healthservice.hse.ie/staff/ procedures-guidelines/digital-health/hsetelehealth-roadmap-2024-2027/

14. The digital transformation in pharmacy: embracing online platforms and the cosmeceutical paradigm shift | Journal of Health, Population and Nutrition | Full Text (biomedcentral.com)

15. https://medium.com/@cookkelly219/ the-influence-of-e-commerce-on-the-otchealthcare-market-8738a17b8b7a

16. https://ispe.org/pharmaceuticalengineering/ispeak

17. https://medium.com/@cookkelly219/ the-influence-of-e-commerce-on-the-otchealthcare-market-8738a17b8b7a

18. IQVIA CH Global Database Audit

19. Australian Respiratory Surveillance Report, Report 6 2024

20. Ipsos (Ireland) Veracity Index 2023 – Who do we trust? | Ipsos

Read August IPN Here

Read our Latest Features